Earlier today, Adani group stocks fell after the Economic Times reported that the National Securities Depository Ltd has frozen the accounts of three foreign entities — Albula Investment Fund, Cresta Fund, and APMS Investment Fund — which collectively possess shares in four Adani Group firms worth over Rs43,500 crore. According to the depository’s website, these accounts were frozen on or before May 31.

Adani Enterprises shares have increased by 741 percent in the last year, Adani Ports by 100 percent, Adani Green by 245 percent, Adani Transmission by 650 percent, Adani Power by 271 percent, and Adani Total Gas by 1066 percent.

According to top executives at custodian banks and legal firms dealing with foreign investors, the freeze on the three accounts might be due to insufficient disclosure of information on beneficial ownership as required by the Prevention of Money Laundering Act (PMLA).

Adani Enterprises was down 25%, Adani Ports was down 17%, Adani Total Gas was down 5%, Adani Green Energy was down 5%, Adani Power was down 5%, and Adani Transmission was down 5%.

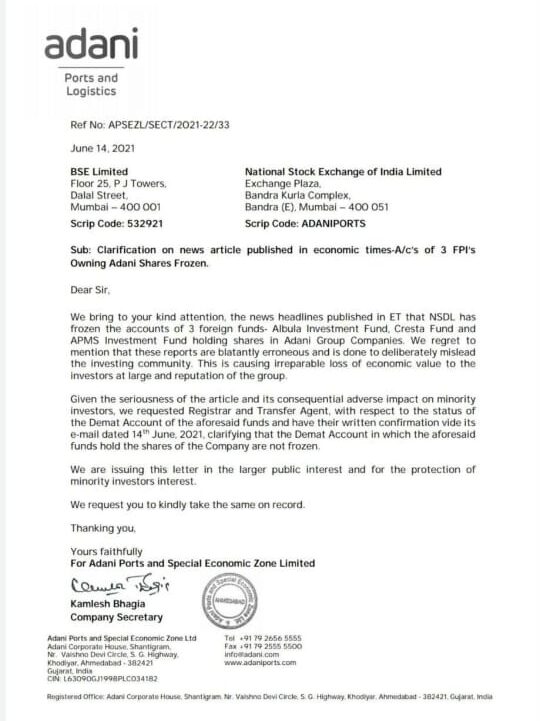

Later today, The Adani Group of Enterprises claims that allegations about the freezing of three foreign funds by National Securities Depository Ltd (NSDL), which own shares in Adani Group companies, are erroneous. According to the corporation, these reports are creating irreparable economic value loss to both the general public and the organisation.

Moreover,According to CNBC-TV18, Albula Investment Fund has also emphasised that the fund is not prohibited in any way and is fully operating. It further said that the fund is fully active in routine trading not just in India, but also internationally.

However, NSDL statistics demonstrate that the accounts of the three foreign portfolio investors are locked, despite the declaration.